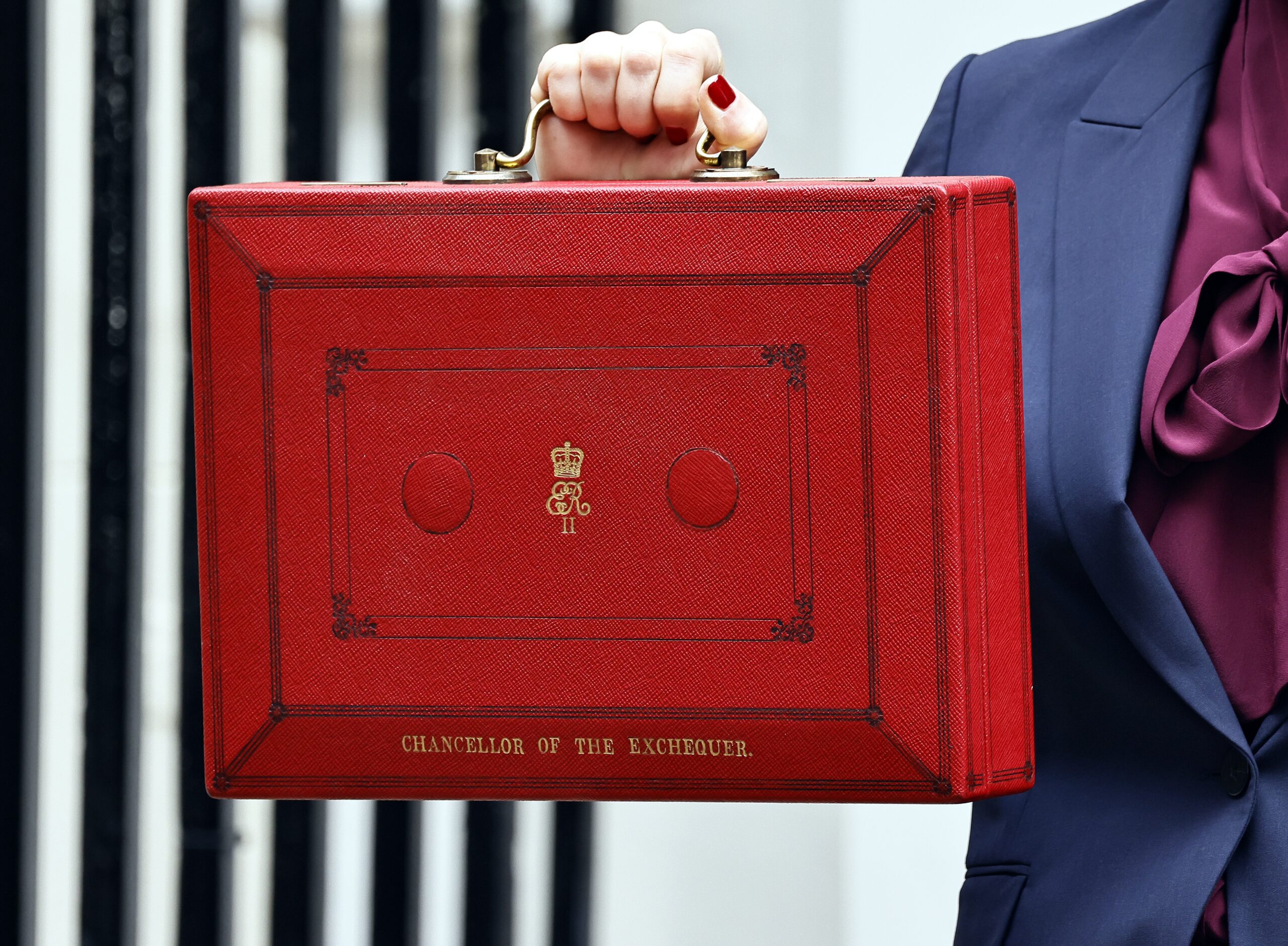

The Autumn Budget delivered a wide range of policy changes that will affect earnings, savings, pensions, and property ownership over the next several years. The Chancellor set out reforms intended to bring government spending and revenue into closer balance, and the result is a package of measures that touches many areas of personal finance. Salary sacrifice arrangements, investment income, property taxation, ISA allowances, and inheritance tax were all addressed. Some measures apply immediately, while many will be introduced gradually between 2025 and 2031.

Salary sacrifice pension contributions

A major announcement concerned the reform of salary sacrifice. From April 2029, there will be a limit on the amount of employee and employer National Insurance that can be saved through salary sacrifice pension contributions. National Insurance savings will apply only to the first £2,000 contributed in this way. Any pension contribution above this amount will attract National Insurance deductions from both the employer and the employee.

Salary sacrifice is currently a popular method of increasing pension savings because it reduces an employee’s National Insurance bill while also reducing the employer’s National Insurance burden. At present, workers can save up to 8% in employee National Insurance on their pension contributions, and employers can save 15% on their side. These savings will be restricted once the new rules begin.

Although the cap will limit the National Insurance benefit for higher earners, income tax relief on pension contributions will remain unchanged. Contributions made through salary sacrifice will still reduce adjusted net income, which for many people helps to keep them out of higher tax brackets. Individuals earning £40,000 or less and contributing 5% of their salary into a pension each year should not be affected by the new limit.

Employers have been given more than three years to review and redesign their pension contribution structures. Some may decide to remove salary sacrifice altogether and move back to the traditional arrangement where employees contribute from their pay. Others may retain salary sacrifice but apply it only to the first £2,000 of contributions. Employers will also lose their own National Insurance savings under the reforms. Some may decide to manage this by adjusting future wage growth and contributing more to pensions instead, although any approach involving changes to pay or benefits will need to be considered carefully in line with employment law.

Lifetime ISA changes

The Government confirmed its intention to remove the Lifetime ISA and replace it with a simpler ISA product aimed at helping first-time buyers. A consultation is planned for early 2026.

Likewise, at the moment, Lifetime ISAs are also widely used by self-employed individuals and others as a retirement savings tool. The newly formed Pensions Commission is still in the early stages of its work, and the Government has stated that it intends to wait for the Commission’s conclusions before making long-term decisions about this area of policy.

Cash ISA allowance reduction

From April 2027, the annual subscription limit for cash ISAs will fall to £12,000 for individuals under the age of sixty-five. Stocks and shares ISA allowances will remain at £20,000. It is not yet clear whether this reduction will be accompanied by restrictions on transfers from stocks and shares ISAs into cash ISAs.

Extension of tax threshold freezes

Income tax thresholds will remain frozen for a further three years, taking the freeze through to April 2031. This means tax bands will have been unchanged for a decade. The nil rate band for inheritance tax will also remain the same until 2031. These frozen thresholds will draw more individuals into higher tax bands over time, particularly as wages increase. Clients may wish to consider using pension contributions, charitable giving, or alternative remuneration structures to manage future tax exposure.

Dividend tax increases from April 2026

Dividend income will become more expensive for many investors. From April 2026, both basic and higher rate taxpayers will face a two percentage point increase in the tax charged on dividend income.

- Basic rate taxpayers will pay 10.75%

- Higher rate taxpayers will pay 35.75%

- The additional rate of 39.35% remains unchanged

Investors who hold shares or funds outside tax wrappers may find it beneficial to use ISAs or pensions ahead of these increases. The £500 dividend allowance will continue.

Savings income tax increase

Savings income will also be affected by the Budget. From April 2027, tax on savings income will increase by two percentage points at every tax band. Basic rate taxpayers will pay 22% on this income, higher rate taxpayers will pay 42%, and additional rate taxpayers will pay 47%.

Separate property income tax bands

From April 2027, new tax rates will apply specifically to property income. These rates will mirror the increases applied to savings income: 22% for basic rate taxpayers, 42% for higher rate taxpayers, and 47% for additional rate taxpayers.

Additional tax for high-value properties

A new annual charge will apply from April 2028 for properties valued above two million pounds. This will operate as a high-value property surcharge paid alongside council tax, although the funds will be collected by the central government. The charge will begin at £2,500 per year and rise in bands up to £7,500 for properties valued at five million pounds or more.

These amounts will increase with consumer price inflation each year. Property valuations for these charges will not follow the current council tax banding process. A deferral scheme will be available for individuals unable to pay immediately. The Office for Budget Responsibility believes this policy will influence property values and may create concentrations of pricing just below each band.

Inheritance tax on pensions

The Government confirmed that unused pension funds will be included in the inheritance tax calculation from April 2027. Personal representatives will be responsible for calculating the inheritance tax that is due and for ensuring it is paid. Under a modification to the previous proposal, personal representatives will have the authority to request that pension schemes withhold up to 50% of the taxable benefits for up to fifteen months in order to help meet the inheritance tax due.

Personal representatives will also be protected from liability for any inheritance tax relating to pensions that are discovered only after HMRC has issued clearance. While this provides more flexibility, the administrative burden remains significant, and many within the pensions industry had hoped for a simpler long-term solution.

Agricultural and business property relief

Further changes were announced to agricultural and business property relief. The one million pound allowance for the 100% rate will become transferable between spouses and civil partners. The Government also intends to amend the rules relating to internationally mobile individuals in order to close loopholes and to place a cap on certain trust-related charges.

Capital Gains tax relief on employee ownership trusts

From November 26th 2025, the Capital Gains tax relief on qualifying disposals to Employee Ownership Trusts will be reduced from 100% to 50%.

Capital allowances from 2026

From early 2026, the main rate of writing down allowances will increase to 14% and a new 40% first-year allowance for main rate assets will be introduced.

National Minimum Wage and National Living Wage

New rates will apply from April 2026. The National Living Wage for individuals aged twenty-one and over will rise to £12.71 an hour. The National Minimum Wage rates for eighteen to twenty-year-olds, sixteen to seventeen-year-olds, and apprentices will also increase.

These changes may affect the amount that some individuals can contribute through salary sacrifice arrangements.

State Pension increases

The Government will retain the triple lock. This means that from April 2026, the new State Pension will increase by £574.60 a year to reach £12,547.60. The Basic State Pension will increase by £439.40 a year to reach £9,614.80.

Supporting your financial planning

The Autumn Budget contains many measures that come into effect over the next several years. Some changes will influence future tax liabilities while others may affect decisions about pensions, property, savings, or remuneration. Taking time to understand how these policies apply to your personal circumstances can help you plan and make informed financial decisions.

Rigby Financial is here to support clients through these changes. If you would like to discuss how the Autumn Budget may affect you, please contact our team for personalised guidance.